Drawing on both experimental evidence as well as a naturally-occurring experiment, researcher find robust evidence that poverty negatively impacts cognitive performance. Poor participants who were experimentally induced to think about how to overcome a financially troubling scenario performed significantly worse in cognitive tasks than the control group. The cognitive performance of the better-off, on the other hand, was unaffected by these induced finance-related thoughts. In India, farmers heavily relying on sugarcane for their income performed significantly worse on cognitive tests pre-harvest, when they were poor, than post-harvest, when they were less poor.

Does poverty have a negative causal effect on cognitive function? This research looks at the immediate impact of poverty on cognitive function in real time, focusing particularly on how budgetary concerns and the need to manage limited financial resources might leave fewer cognitive resources available for other tasks.

Poverty correlates with a number of counterproductive behaviors that may further perpetuate it, including using less preventative health care, failing to adhere to drug regimens or failing to properly manage finances (Katz & Hofer, 1994; DiMatteo et.al., 2002; Barr, 2012). Much of the literature has sought to attribute these behaviours to either environmental factors, such as poor public services and infrastructure, or to the characteristics of the poor themselves, such as low levels of schooling.

This study tests a very different potential explanation: that poverty in itself reduces cognitive capacity, which in turn can lead to these suboptimal behaviours. This hypothesis is premised on the idea that, by being forced to direct limited mental resources to worry about, and manage financially challenging situations, the poor have fewer mental resources left for other tasks. Thus, poverty in itself acts as a “mental tax.”

To test the hypothesis that poverty impedes cognitive function, the study relies on a purely experimental component and on a natural experiment.

The purely experimental component was composed of four “sub-experiments” and involved shoppers at a mall in New Jersey who were paid to participate. The incomes of participants ranged widely, from a median of $70,000 to a lower-bound of $20,000. The poor in the sample fell in the lower quartile/third of the US income distribution.

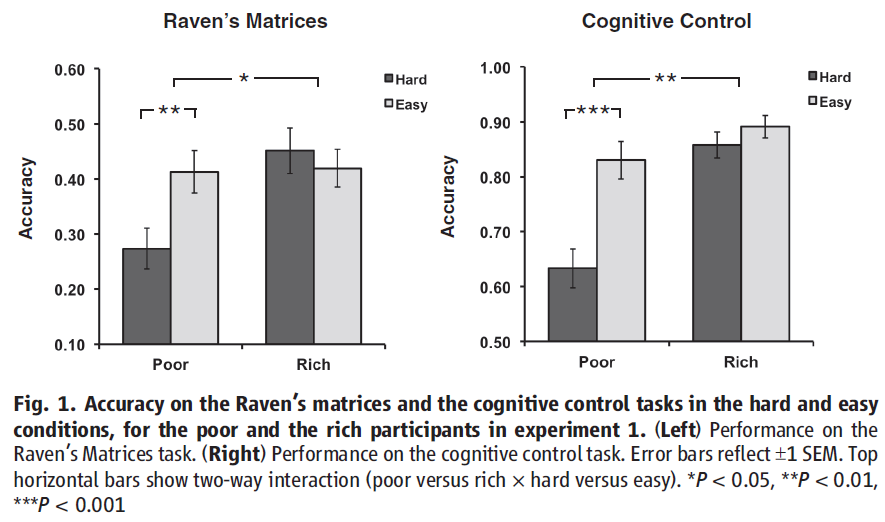

In the first “sub-experiment”, participants were presented with four hypothetical scenarios describing a financial problem that they might experience, such as having to pay for a car repair, and how they would go about addressing this financial challenge. The goal of these scenarios was to “prime” participants into thinking about financial concerns. Immediately afterwards, while still thinking about the financial problem, participants performed two computer-based tasks used to measure cognitive function: Raven’s Progressive Matrices, which is often used in IQ tests to measure “fluid intelligence” – the capacity to think logically and solve novel problems – and a spatial compatibility test, which measures the ability to engage in complex goal-oriented thought. After completing these tasks, participants submitted their answer to the hypothetical finance-related scenarios. Participants were also randomised into a “hard condition,” in which the scenarios involved larger monetary costs, or an “easy condition,” where scenario where these were lower.

The other three “sub-experiments” were aimed at narrowing down mechanisms and bolstering the robustness of results. These involved: 1) using the same set of numbers as in the experiment above but with non-financial scenarios in order to rule out “math anxiety” as a mechanism; 2) adding monetary rewards for each correct answer in the cognitive tests; 3) allowing participants to finish responding to the scenarios before the cognitive tasks.

While these experiments provide a means of testing potential mechanisms of impact, they are limited by the fact that they lack external validity; priming participants to think about monetary concerns is unlikely to mimic the real-world monetary concerns faced by the poor.

To address this issue of external validity, a second study measures the cognitive function of 464 sugarcane farmers in 54 villages in the sugarcane-growing regions around the districts of Villupuram and Tiruvannamalai in Tamil Nadu, India. These farmers are characterised by a heavy reliance on sugarcane for their income, making up at least 60% of their total income. These farmers receive most of their income at harvest time, which means that their levels of poverty and of financial concerns will be naturally higher pre-harvest than post-harvest. By comparing the cognitive function of the same farmer before and after harvest, differences in cognitive performance can be attributed to the levels of poverty experienced at the time of the tasks.

Experimentally inducing thoughts about financial problems had a negative effect on the cognitive performance of the poorer participants, but did not affect the performance of the better-off participants. This only applied to financial concerns that were large enough in size, however; when the induced finance-related thoughts involved small sums of money, there was no difference in performance between the poor and the better-off. This result holds across all four versions of the experiments. These results suggest that financial concerns impose a higher “cognitive tax” on the poor than on the non-poor.

This finding is corroborated by the results based on sugarcane farmers in India. The same farmers performed significantly worse pre-harvest, while poor, than post-harvest, while less poor. This difference cannot be attributed to differences in nutritional status, time the farmers have available or exerted effort prior to the cognitive tasks. Moreover, while farmers experienced higher stress pre-harvest, the differences in cognitive performance remain after controlling for stress, which suggests that stress cannot explain the reduction in cognitive function.

Taken together, the results suggest that poverty in itself imposes a significant cognitive burden on the poor. As a benchmark, evoking financial concerns has a comparable cognitive impact to losing a full night’s sleep. The findings have important policy implications. Policies should be designed in ways that minimise the cognitive burden on participants. For example, simplifying administrative processes and forms, sending reminders, or having default options in different policy instruments might be particularly helpful for the poor. The timing of informational interventions, such as agricultural extension programmes or HIV-related educational sessions, could also be optimised by targeting these times of lower poverty-induced cognitive tax, such as after harvest.

Katz, S.J. and Hofer, T.P., 1994. "Socioeconomic disparities in preventive care persist despite universal coverage: breast and cervical cancer screening in Ontario and the United States". Jama, 272(7), pp.530-534.

DiMatteo, M.R., Giordani, P.J., Lepper, H.S. and Croghan, T.W., 2002. "Patient adherence and medical treatment outcomes: a meta-analysis". Medical care, pp.794-811.

Barr, M.S., 2012. "No slack: The financial lives of low-income Americans". Brookings Institution Press.