Measuring Time Preferences Using Behavioural Tasks with Monetary Rewards

How much we care about the future is fundamental to understand some of the choices we make. How much do we value a snack today relative to tomorrow? Would our answer change if we were asked how we would value a snack in four weeks relative to the same snack in four weeks and one day?

The snack example might seem overly abstract and unlikely to ever occur in the real-world. However, how we value time influences important decisions, such as investments in education, mortgage borrowing, and saving for retirement.

Economists, behavioural scientists and other social scientists have been designing several methods to elicit individual’s preferences about their perception of future costs and benefits. In this post, we outline two commonly-used behavioural tasks with (real or hypothetical) monetary rewards used to elicit “time-preferences” in surveys: Multiple Price Lists (Andersen, Harrison, Lau, & Rutström, 2008) and Convex Time Budgets (Andreoni & Sprenger, 2012).

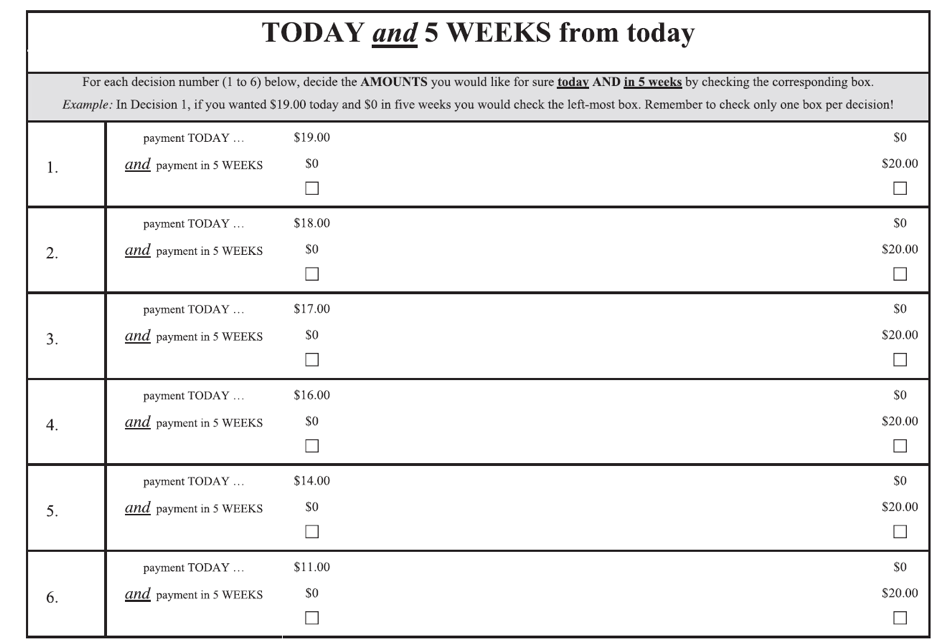

This task asks respondents to choose how much money to allocate to a smaller payment at an earlier date and a larger payment at a later date. It is important to note that we may also keep the monetary rewards fixed, but vary the time-frames used. Doing so can give some indication of present- or future-bias in our sample.

(example from Andreoni and Sprenger, 2012)

The task can involve: (1) Hypothetical intertemporal choices; (2) Incentivized intertemporal choices. If incentivized, one of the choices will be selected at random and the participants will receive whatever they chose in that question. If on that trial they selected an immediate amount of money, they will receive the money in cash at the end of the session. Otherwise, subjects may be asked to come back to the experimental venue, or a mobile-money option would need to be setup to make sure that later date payments are sent at the chosen time.

| Advantages | Disadvantages |

|

|

|

|

|

|

|

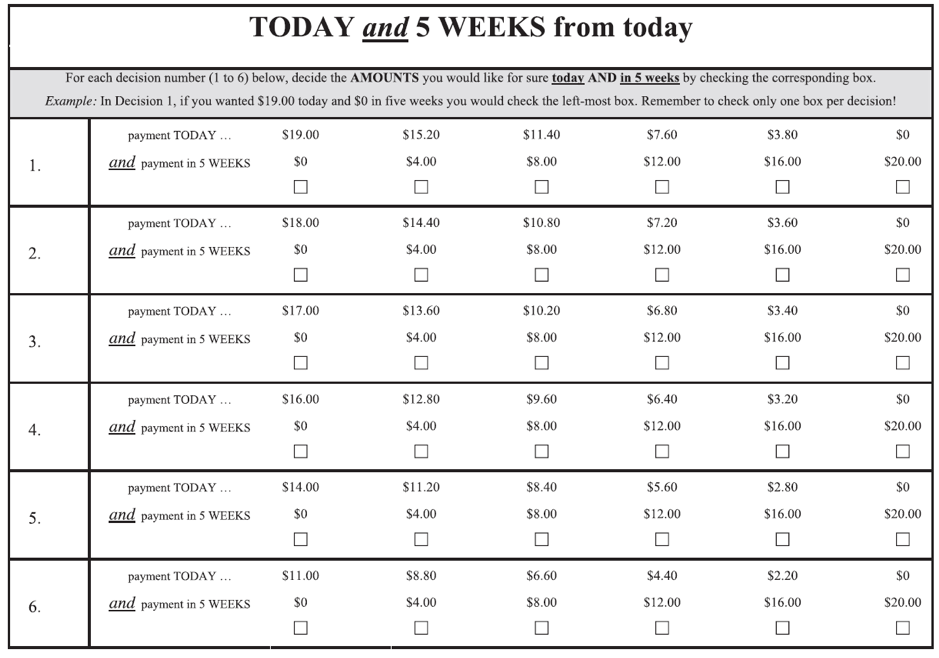

This task asks respondents to choose how much money to allocate to a payment at an earlier date and a payment at a later date. Each question involves different amounts and different time periods. This task is meant to elicit respondents’ preferences for money at different points in time.

The key difference relative to the MPLs is the fact that for each choice, participants are presented with multiple monetary outcomes that vary across both earlier and later rewards. This difference relaxes the somewhat unrealistic assumption of an underlying linear utility function.

Esopo et al. (2018) outline a list of caveats that are worth acknowledging when using these tasks to elicit time preferences, particularly in low- and middle-income countries:

- First, a common criticism of monetary discounting tasks is that money is fungible and, therefore, these tasks may not capture time preferences over consumption in the presence of functioning credit markets (Augenblick, Niederle, & Sprenger, 2015).

- Second, monetary tasks involve payments, while an effort task involves small behavioral costs; this makes an effort task a better model of adherence behavior, which also involves small behavioral costs (e.g. seeing a doctor).

- Third, using monetary incentives to elicit time preferences may be inappropriate in developing countries since individuals might discount money for situational reasons other than preferences; for example, a participant might demonstrate low discount rates in a monetary discounting task when they have enough food on the table, but show different preferences when food is scarce because they need the money immediately. Indeed, Carvalho et al. (2016) show that low-income participants are present-biased, giving stronger weight to payoffs that are closer to the present rather than the future when making choices in a monetary discounting task before payday, but do not show present bias in non-monetary real effort tasks under these circumstances.

Andersen, S., Harrison, G. W., Lau, M. I., & Rutström, E. E. (2008). Eliciting risk and time preferences. Econometrica, 76(3), 583–618.

Andreoni, J., & Sprenger, C. (2012). Estimating time preferences from convex budgets. The American Economic Review, 102(7), 3333–3356.

Augenblick, N., Niederle, M., & Sprenger, C. (2015). Working over time: Dynamic inconsistency in real effort tasks. The Quarterly Journal of Economics, 130(3), 1067–1115.

Carvalho, L. S., Meier, S., & Wang, S. W. (2016). Poverty and economic decision-making: Evidence from changes in financial resources at payday. The American Economic Review, 106(2), 260–284.

Esopo, K., D. Mellow, C. Thomas, H. Uckat, J. Abraham, P. Jain, C. Jang, N. Otis, M. Riis-Vestergaard, A. Starcev, K. Orkin*, J. Haushofer*. 2018. "Measuring Self-Efficacy, Executive Function, and Temporal Discounting in Kenya." Behaviour, Research and Therapy, 101: 30-45. (* denotes equal contribution).